Interest rates play a crucial role in shaping the housing market, influencing both home prices and buyer demand. Over the past few years, rising mortgage rates have significantly impacted affordability, making it more challenging for buyers to enter the market. While housing demand remains strong, interest rates on the housing market continue to be a key factor in determining trends in home sales and pricing.

1. How Interest Rates Affect Home Sales

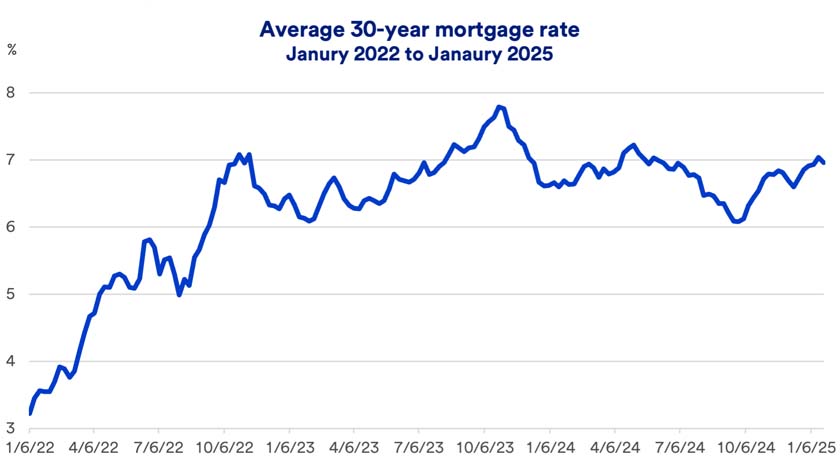

Mortgage rates have fluctuated significantly since 2022. As of early 2025, 30-year mortgage rates hover around 7%, which is lower than the peak levels of 2024 but still much higher than pre-2022 rates.

Despite these high rates, home sales showed some improvement toward the end of 2024. December saw a 2.2% increase in existing home sales compared to the previous month, marking the third consecutive month of growth. However, on an annual basis, 2024 recorded the lowest number of home sales in nearly 30 years.

According to Rob Haworth, a senior investment strategy director with U.S. Bank Asset Management, “Housing activity remains low from a historical perspective, but recent data suggests the market is stabilizing.”

2. Inventory Challenges in a High-Rate Market

One of the major concerns in the current housing market is low inventory. Many homeowners with low-interest mortgages are reluctant to sell their homes and take on a new loan with a higher rate. This phenomenon, known as the mortgage lock-in effect, has kept inventory levels stagnant.

“Higher rates are making people in homes financed with low mortgage rates reluctant to move,” says Haworth. “The challenge is that we ultimately need more homes on the market.”

While new home sales also increased by 3.6% in December 2024, the pace of new construction remains uncertain. Market factors such as labor shortages, supply chain disruptions, and rising building costs continue to impact homebuilder sentiment and the availability of new housing.

3. Why Are Mortgage Rates Rising?

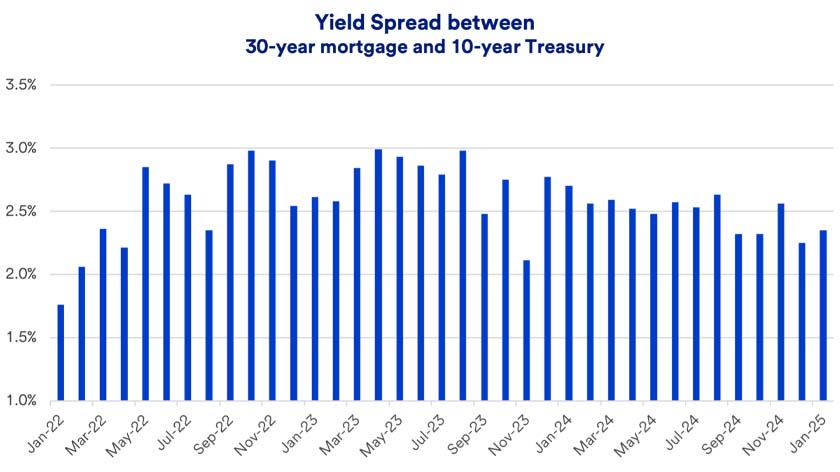

Mortgage rates are influenced by several factors, including the bond market and Federal Reserve policies. Currently, higher mortgage rates are partially driven by:

- Increased yields on government bonds (such as the 10-year U.S. Treasury note).

- The Federal Reserve reducing its holdings of mortgage-backed securities, which lowers liquidity in the mortgage market.

- Persistent inflation concerns, which may keep interest rates elevated.

“The combination of rising home prices and elevated mortgage rates means that housing affordability remains a meaningful problem,” explains Haworth.

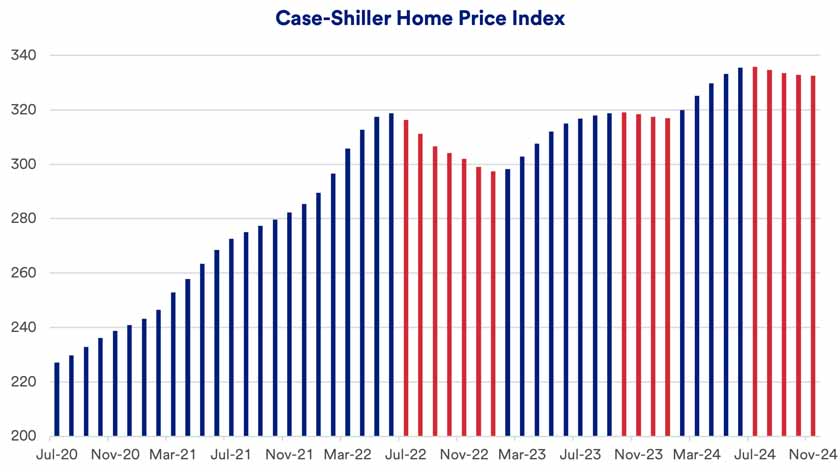

4. Home Prices and Mortgage Rates: A Challenging Combo

Although mortgage rates remain high, home prices are still elevated. In mid-2024, home prices reached all-time highs, according to the Case-Shiller Home Price Index. However, from August to November, prices declined slightly—dropping less than 1% from peak levels.

Despite this minor correction, affordability remains a concern. Redfin reported that the median monthly mortgage payment in January 2025 was $2,686, the highest since June 2024 and 7.6% higher than a year earlier.

5. Real Estate Investment Trusts (REITs) in a High-Rate Environment

Rising interest rates have also impacted real estate investment trusts (REITs). In recent years, REITs have underperformed compared to the broader stock market. However, as of early 2025, REITs are showing signs of improvement, gaining 2.60% year-to-date compared to 2.30% for the S&P 500.

“High interest rates have put pressure on REITs,” says Haworth. “However, they currently offer comparable income to today’s attractive 10-year U.S. Treasury yields, making them a reasonable diversification opportunity for investors.”

6. The Future of Interest Rates on the Housing Market

There is still uncertainty about where mortgage rates will go in the coming months. Several factors could impact future rate changes:

- Federal Reserve policies: If inflation remains under control, the Fed may slow down rate hikes, leading to lower mortgage rates.

- Housing supply growth: More homes hitting the market could help balance pricing and demand.

- Economic policies: Potential policy changes related to immigration and tariffs could affect labor and building costs.

As Haworth points out, “There’s a lot we don’t know about how policies in the next 3-6 months might impact interest rates, inflation, and building supplies.”

Final Thoughts

Interest rates on the housing market continue to play a crucial role in shaping buyer activity and home affordability. While mortgage rates have remained high, home sales have shown signs of recovery, and new construction continues to play an important role in meeting demand.

For both homebuyers and sellers, understanding how interest rates impact the market is essential. Whether you’re looking to buy, sell, or invest, staying informed about rate trends can help you make smarter real estate decisions in 2025 and beyond.