Processing payroll can be a time-consuming and complex task for businesses. With tax calculations, compliance requirements, and payment processing, some employers spend nearly 21 days per year handling payroll (Bloomberg Tax). Fortunately, payroll software can simplify the process, minimize errors, and ensure employees are paid correctly and on time.

What is Payroll Processing?

Payroll processing involves calculating and distributing employee wages while ensuring compliance with tax regulations. This includes tracking employee hours, calculating wages, managing payroll deductions, issuing payments, and submitting payroll taxes to the appropriate government agencies.

Steps to Process Payroll

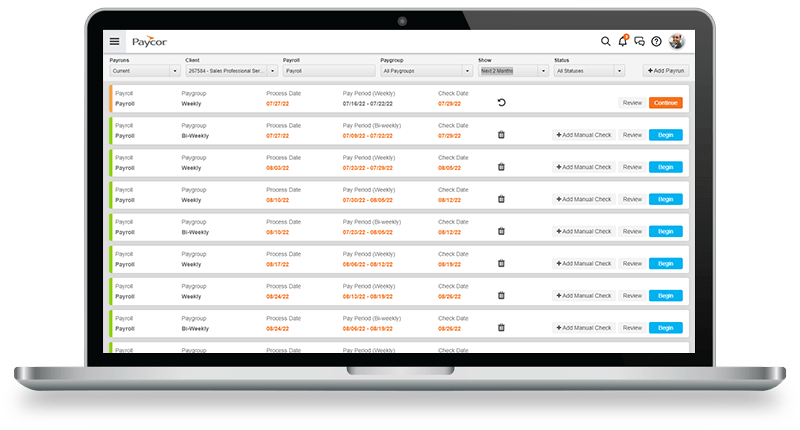

1. Choose a Pay Schedule

The pay schedule you select impacts employee satisfaction and financial stability. The most common payroll schedules include:

- Biweekly: Employees receive paychecks every two weeks, commonly used in industries with high turnover.

- Semi-monthly: Payments are made twice a month, such as on the 15th and the last day of the month.

- Monthly: Employees receive one paycheck per month, suitable for businesses with predictable work hours.

Before selecting a schedule, consider your budget, industry standards, and legal requirements.

2. Obtain Employer Identification Numbers (EIN)

Before processing payroll, employers need specific tax identification numbers, including:

- Employer Identification Number (EIN): Issued by the IRS.

- State/Local Tax ID: Required for state tax compliance.

- State Unemployment ID: Used for unemployment insurance reporting.

These numbers are necessary for tax filing and payroll processing.

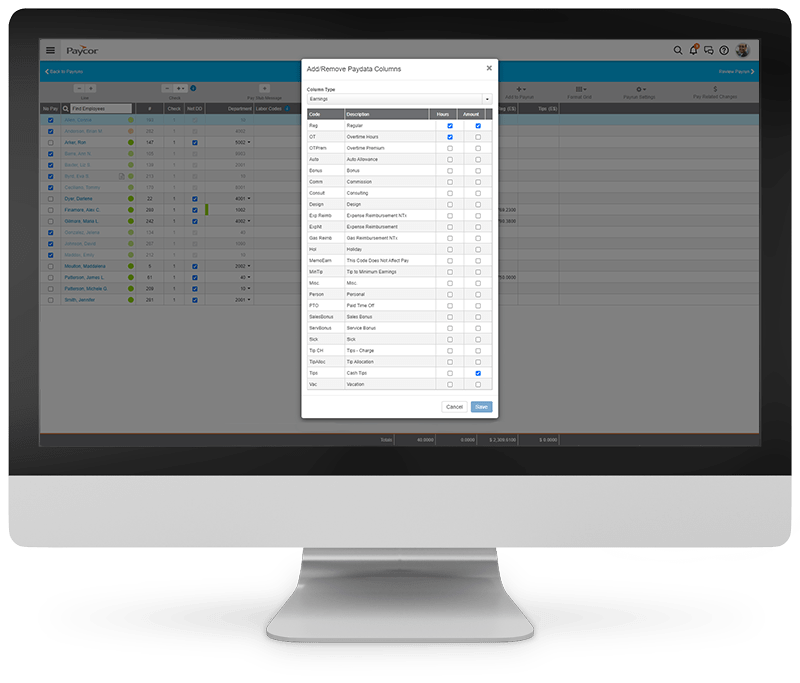

3. Set Up Your Payroll System

A well-structured payroll system ensures accurate record-keeping. To organize payroll, employers should:

- Establish general ledger accounts for payroll transactions.

- Define earning codes to categorize different wages.

- Set up deductions for benefits like health insurance and retirement plans.

- List tax withholdings at the local, state, and federal levels.

Using payroll software can help automate these processes and prevent errors.

4. Collect Employee Information

Accurate payroll processing requires gathering employee details, such as:

- Completed W-4 forms (or state equivalents) for tax withholding.

- I-9 forms for work eligibility verification.

- W-9 forms for independent contractors.

- Social Security Numbers (SSNs).

- Bank account details for direct deposit.

- Retirement plan and insurance documents.

Maintaining organized records prevents payroll discrepancies and tax issues.

5. Track Employee Hours

Employee work hours are essential for accurate payroll calculations. Businesses can track hours using:

- Manual timesheets: Suitable for small teams.

- Time-tracking software: Automates attendance records and reduces errors.

- Payroll-integrated scheduling tools: Simplifies the process of importing hours into payroll systems.

Accurate timekeeping prevents payroll mistakes and ensures fair compensation.

6. Calculate Employee Pay

Once hours are tracked, calculate gross wages by multiplying hours worked by the hourly rate. For salaried employees, divide the annual salary by the number of pay periods. Deductions must be subtracted, including:

- Federal and state income taxes.

- Social Security and Medicare contributions.

- Health insurance and retirement contributions.

Payroll software can automate these calculations and apply tax rates accurately.

7. Issue Employee Payments

After calculating net pay, issue payments through:

- Direct deposit: The most convenient and secure method.

- Paper checks: Useful for employees without bank accounts.

- Payroll cards: Preloaded with employee wages.

Employers should confirm payment methods with employees before processing payroll.

8. File Payroll Taxes

Employers must withhold and submit payroll taxes on behalf of employees. This includes:

- Federal Income Tax: Based on W-4 forms.

- Social Security and Medicare (FICA) Taxes: Split between employers and employees.

- State and Local Taxes: Vary by location.

- Unemployment Taxes: Paid at the state and federal levels.

Taxes must be filed according to IRS deadlines to avoid penalties.

9. Maintain Payroll Records

Employers should keep payroll records for at least three years, including:

- Employee earnings and hours worked.

- Tax withholdings and payment confirmations.

- Payroll reports and compliance documents.

Organized records help resolve disputes and simplify audits.

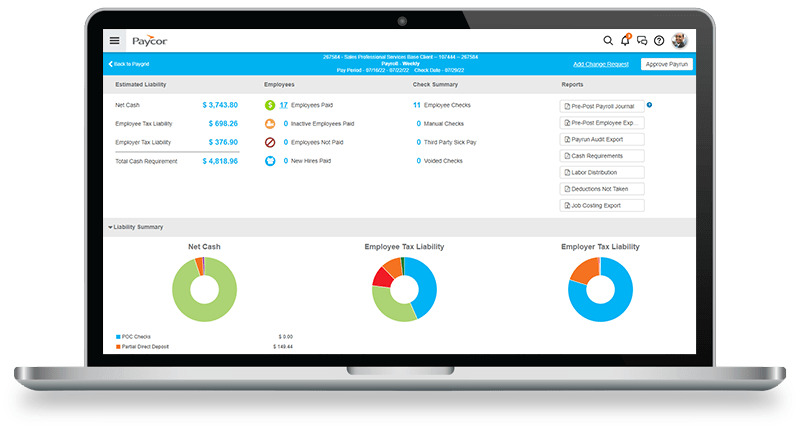

Simplifying Payroll Processing

Payroll processing doesn’t have to be overwhelming. Using payroll software can streamline calculations, automate tax filings, and ensure compliance with labor laws. Whether you manage payroll manually or use a payroll provider, following these steps will help keep your employees paid accurately and on time.