If your small business has employees, you need a reliable system for processing payroll, withholding taxes, and keeping accurate records. But how much does payroll cost for small businesses? The price of payroll services can vary greatly depending on your business’s needs, from a few dollars a month to thousands. So, how do you know if you’re paying too much for payroll, or if you need help budgeting for a dependable payroll process? This article will help you understand payroll service costs and how to manage them effectively.

How Much Does Payroll Cost?

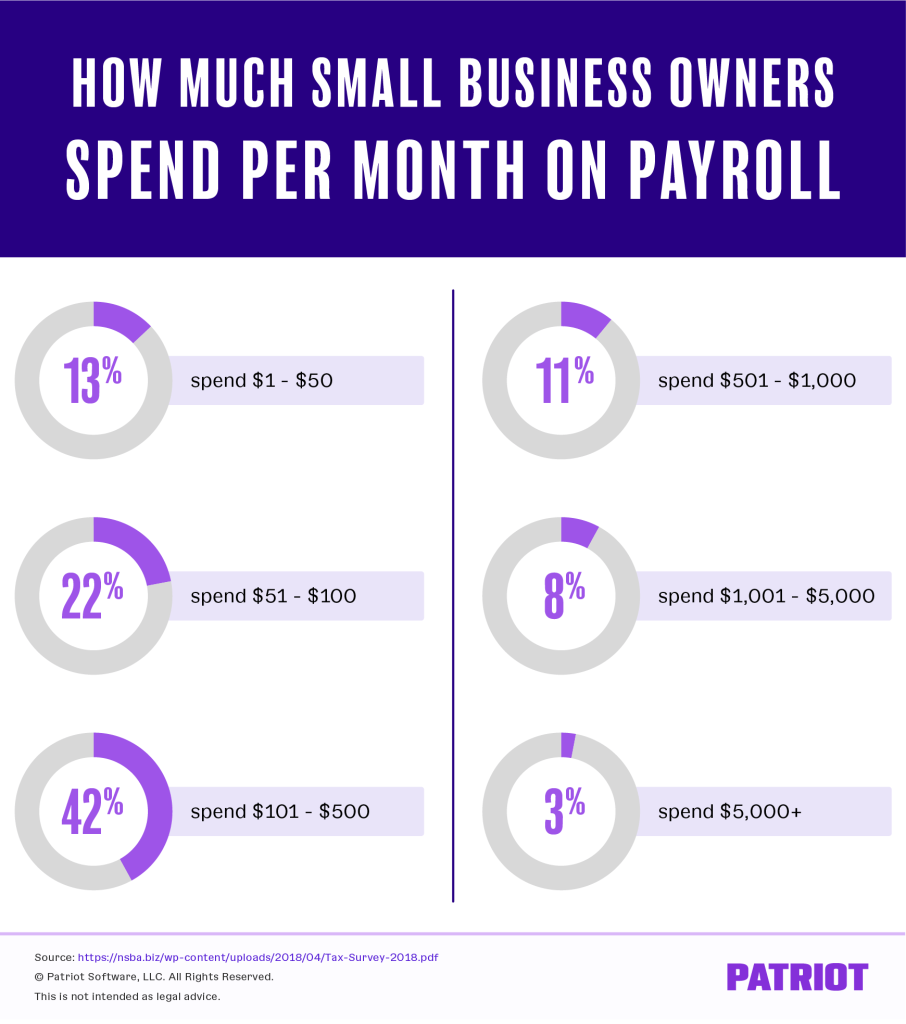

There isn’t a one-size-fits-all answer when it comes to payroll services costs. Your payroll expenses will depend on factors such as the number of employees you have and how you handle payroll. However, you can get a better sense of the typical costs by looking at how much other small businesses spend.

According to the National Small Business Association’s Small Business Taxation Survey, which surveyed small business owners in various industries, the monthly payroll costs for small businesses were reported as follows:

- $1 – $50: 13% of businesses

- $51 – $100: 22% of businesses

- $101 – $500: 42% of businesses

- $501 – $1,000: 11% of businesses

- $1,001 – $5,000: 8% of businesses

- $5,000+: 3% of businesses

What’s Included in Payroll Costs?

Payroll can be a major expense for small businesses, and understanding what’s included in the costs can help you budget effectively. Payroll services typically cover the following:

- Employee Wages, Salaries, and Benefits: The biggest part of your payroll costs will be the wages you pay your employees. This includes their base pay, overtime, bonuses, commissions, and benefits like health insurance, retirement contributions, and other perks.

- Payroll Taxes: As an employer, you’re responsible for withholding the correct amount of taxes from your employees’ paychecks. Additionally, you need to pay employer taxes like Social Security, Medicare, and unemployment taxes (both federal and state).

- Administrative Costs: These costs include everything related to processing payroll, such as calculating employee wages, paying employees, remitting taxes to the correct authorities, and filing reports. Whether you do this yourself or hire someone to help, administrative costs are an essential part of payroll services.

What Affects Payroll Service Costs?

Several factors can impact how much you’ll pay for payroll services. Here’s a breakdown of your options:

- Hiring a Professional: Hiring an accountant or payroll service provider is usually the most expensive option, but it can save you time and reduce the risk of errors. Payroll professionals may charge a flat fee or a percentage of your employees’ wages. The more employees you have, the higher the cost will typically be. You can outsource payroll to an accountant or a Professional Employer Organization (PEO) for a more comprehensive service.

- Managing Payroll by Hand: Running payroll yourself, without software, is the least expensive option at first glance. However, it can be very time-consuming and prone to costly mistakes, such as penalties for incorrect tax filings or late payments. You might also need to pay transaction fees if you transfer money via direct deposit, or the cost of check printing if you issue physical checks. Additionally, you must track employee hours and handle tax filings on your own, which can eat into your time and increase your workload.

- Using Payroll Software: Software is a good middle ground, providing a more cost-effective solution than hiring a professional, while still offering support to reduce human error. Payroll software charges may be based on a monthly fee or per employee. Some software providers offer packages that include features like free direct deposit, so you can avoid transaction fees. There are also full-service payroll systems that can handle tasks like tax filing and remitting payments for you, but they may be more expensive than basic options.

How Much Does Payroll Software Cost?

The cost of payroll software varies depending on the provider, the number of employees, and the features you choose. Basic payroll systems may cost between $10 and $50 per month, while full-service options could range from $50 to $200 per month or more. Some software charges a per-employee fee, which can add up depending on how large your business is.

Before deciding on payroll software, it’s important to research and compare providers. Many offer free trials, so you can test the system before committing. Avoid signing up for long-term contracts unless you’re sure the software is right for your business.

How Much Do Accountants Charge for Payroll Services?

The fees accountants charge for payroll services can vary widely depending on your business’s specific needs, such as the number of employees and whether you have employees across different states. It’s a good idea to schedule a consultation with an accountant to discuss your business’s payroll needs and get an estimate of their fees.

Can I Do My Own Payroll?

Yes, you can handle payroll yourself, and many small business owners choose this route. Payroll software can make the process easier by automating tasks like calculations and tax filings, which helps minimize errors and saves time. However, if you choose to handle payroll yourself, you’ll need to ensure that you stay up to date with tax rates and other regulations, which can be a lot of work.

How to Calculate Total Payroll Costs

To estimate your total payroll costs, you’ll need to include all the components: employee wages, employer taxes, benefits, and the cost of processing payroll. Here’s a simple formula:

Total Payroll Costs = Employee Wages + Benefits + Employer Taxes + Administrative Costs

For example, if you have one employee earning $40,000, and you spend $8,500 on benefits, $3,669 on employer taxes, and $504 annually on payroll software, your total payroll costs would look like this:

$40,000 + $8,500 + $3,669 + $504 = $52,673

How to Optimize Payroll Costs

If you’re looking to reduce payroll costs, consider these strategies:

- Use payroll software: Investing in payroll software can help you save time and money by automating tasks and reducing the risk of errors.

- Compare costs: Shop around for the best payroll software and compare prices, keeping in mind that some providers may charge extra fees for additional services.

- Audit your costs regularly: Don’t be afraid to switch providers if you feel like your payroll costs are too high.

Final Thoughts

Payroll service costs are influenced by factors such as the type of service you choose, the number of employees you have, and the complexity of your payroll needs (e.g., multi-state payroll). Be sure to research your options carefully to find the best payroll solution for your small business.

For example, Patriot Payroll offers two pricing options:

- Basic Payroll: $17/month plus $4 per employee

- Full-Service Payroll: $37/month plus $5 per employee, including tax filings and deposits

Patriot also offers a 30-day free trial and a 50% discount for the first three months, making it an affordable option for small businesses.

Understanding and managing payroll costs is essential for running a small business smoothly. By researching your options, comparing costs, and using the right tools, you can find a payroll solution that meets your needs and fits your budget.