Insurance can often seem complicated, leading to many misconceptions about how policies work and what coverage is necessary. Whether it’s auto, homeowners, life, or disability insurance, understanding the facts can help you make better financial decisions. Here, we debunk 10 common myths about insurance to help you separate fact from fiction.

Myth #1: You Don’t Need Life Insurance If You’re Single and Healthy

Fact: Even if you’re single and in good health, life insurance can provide financial security for your loved ones. It can cover funeral expenses, outstanding debts like private student loans, and even provide financial support for younger siblings or extended family members. Buying a policy while young and healthy also means lower premiums and better coverage options.

Myth #2: You’re Too Old to Get Life Insurance

Fact: Life insurance is available for people of all ages. While premiums may be higher for older individuals, there are still many options for coverage. Some policies don’t require medical exams, making it easier to qualify even later in life.

Myth #3: Life Insurance Only Benefits Your Heirs

Fact: A well-structured life insurance policy can benefit you during your lifetime. Policies with cash value can be used to supplement retirement income, pay for major expenses like college tuition, or finance home improvements. You can also borrow against the policy in times of need.

Myth #4: Only Breadwinners Need Life Insurance

Fact: Stay-at-home parents and caregivers provide significant financial value, even if they don’t earn a paycheck. The cost of replacing their services, including childcare, household management, and transportation, can be substantial. Life insurance can help cover these costs in case of an unexpected loss.

Myth #5: Employer-Provided Life and Disability Insurance Is Enough

Fact: While employer-sponsored insurance is a great benefit, it often provides only minimal coverage. Many employer policies cover only a fraction of your income and don’t include bonuses or commissions. If you leave your job, you may lose your coverage altogether. Having your own policy ensures you remain protected no matter where you work.

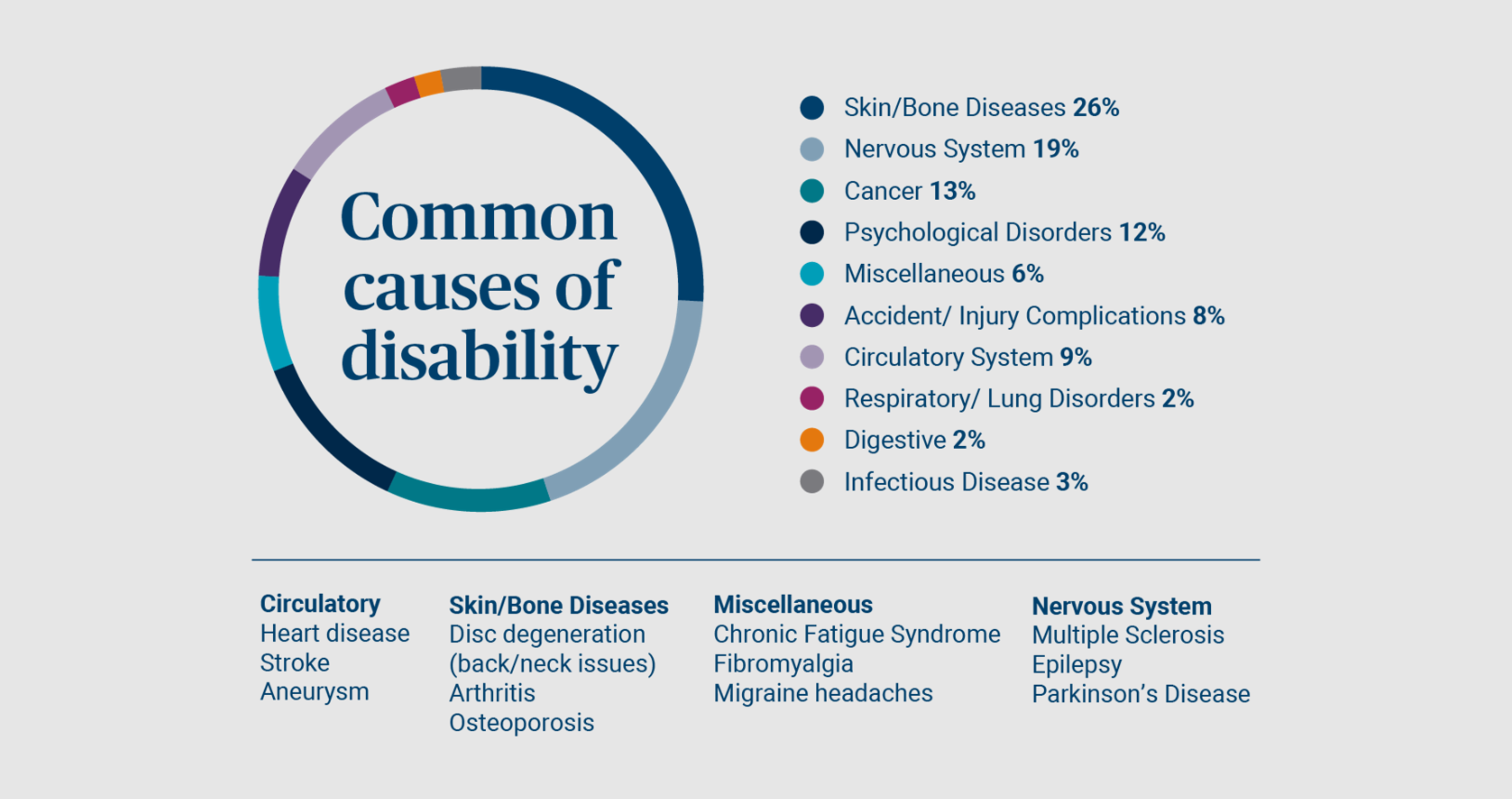

Myth #6: Disability Insurance Only Covers Accidents

Fact: Most disability claims arise from illnesses, not accidents. Conditions like cancer, heart disease, and mental health disorders often lead to long-term disability. Protecting your income with disability insurance is a smart way to prepare for unexpected health challenges.

Myth #7: Medicare Covers All Long-Term Care Needs

Fact: Medicare provides only limited coverage for short-term skilled nursing care. It does not cover extended stays in nursing homes or home health care for long-term needs. Long-term care insurance can help bridge this gap and provide financial assistance for ongoing care.

Myth #8: Long-Term Care Insurance Is a Waste If You Don’t Use It

Fact: There are hybrid policies that combine life insurance with long-term care benefits. If you don’t need long-term care, your policy can still provide a death benefit for your heirs. This ensures that your investment in insurance remains beneficial.

Myth #9: A Low Deductible Is Always Best

Fact: While a low deductible means you’ll pay less out-of-pocket for a claim, it also results in higher premiums. If you have savings set aside for emergencies, opting for a higher deductible can lower your insurance costs over time.

Myth #10: Umbrella Insurance Is Only for the Wealthy

Fact: Lawsuits can happen to anyone, and the costs of legal defense and settlements can be overwhelming. Umbrella insurance provides additional liability coverage beyond your auto or homeowners policy, protecting you from unexpected financial burdens.

Final Thoughts

Understanding the realities of insurance can help you make informed choices about coverage. Whether you need life, health, auto, or disability insurance, debunking these myths ensures you get the protection that’s right for you. Consulting with an insurance advisor can also help tailor a plan to fit your needs and budget.