in a world where convenience reigns supreme, the quest for new housing has seamlessly transitioned into the digital realm. Weather you’re a first-time renter, a seasoned homeowner looking to downsize, or a student searching for the perfect apartment, applying for housing online opens up a universe of opportunities. But amid the clicks and scrolls lies an essential question: what documents do you need to have on hand to navigate this process with ease? In this article, we will illuminate the key paperwork and information required to streamline your online housing submission, ensuring that you’re well-prepared to take the next step toward finding your ideal living space. From financial statements to identification, we’ll guide you thru the essentials you need to gather before embarking on your virtual quest for a new home.

Essential Identification Documents for Online Housing applications

When applying for housing online, having a well-organized set of identification documents is crucial. First and foremost, you’ll typically need to present proof of identity. this often includes a government-issued photo ID such as a driver’s license or passport. Additionally, providing a Social Security number helps confirm your identity and can be a requirement for background checks. Also, it’s advisable to prepare a recent utility bill or bank statement that shows your current address; these can be useful to establish residency if needed.

Aside from identity verification, financial documentation plays a key role in the application process. Many landlords and property managers request recent pay stubs or tax returns to assess your income level. This gives them a clearer picture of your financial stability and ability to pay rent consistently.It’s also beneficial to have a completed rental application form on hand; this may vary by property but usually includes personal details, rental history, and references. Keeping these documents ready will streamline your application and help you secure your desired housing more efficiently.

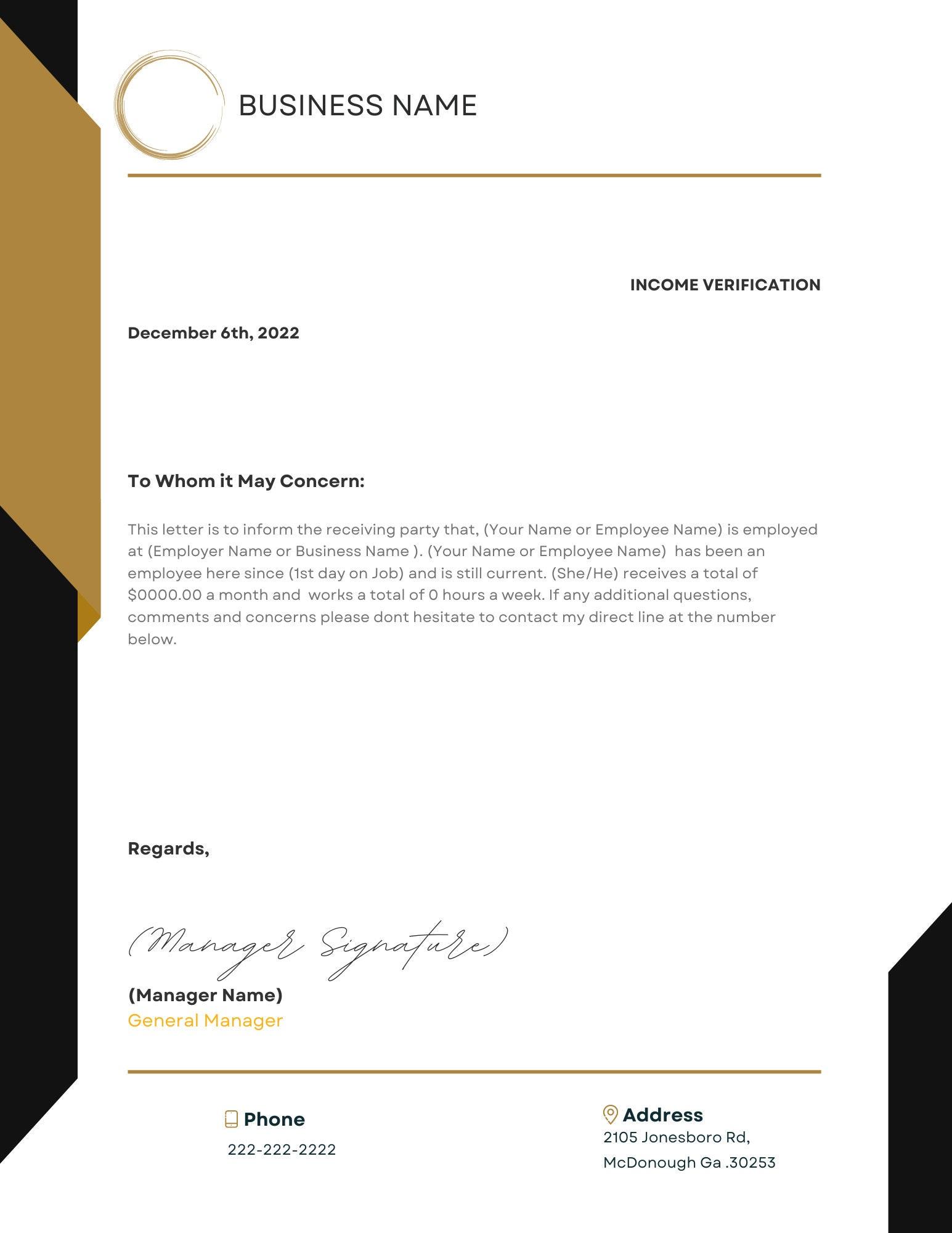

Income Verification: Preparing Your Financial Proofs

When preparing to apply for housing online, the most crucial step is gathering your financial proofs for income verification. Having the right documents at hand not only streamlines the application process but also enhances your credibility as a potential tenant. Common documents you should consider including are:

- Pay Stubs: the last two to three months of pay stubs are essential to verify your current employment income.

- Tax Returns: Providing the most recent tax returns can definitely help showcase your annual income, especially if you are self-employed.

- Bank Statements: A couple of recent bank statements can demonstrate your financial stability and ability to meet rent payments.

- Employment Verification Letter: A letter from your employer stating your position and income can add an extra layer of assurance.

It’s also critically important to note that certain situations may require additional documentation. For instance, if you receive income from multiple sources, or if you are relying on government assistance, you might want to include documents like:

- Social Security Statements: These can validate any income received from government programs.

- Alimony or Child Support Documentation: If applicable, having court documents that support these claims is beneficial.

Given the variety of income scenarios, it’s wise to analyze your specific situation and prepare accordingly, ensuring all proofs are clear, up-to-date, and well-organized.

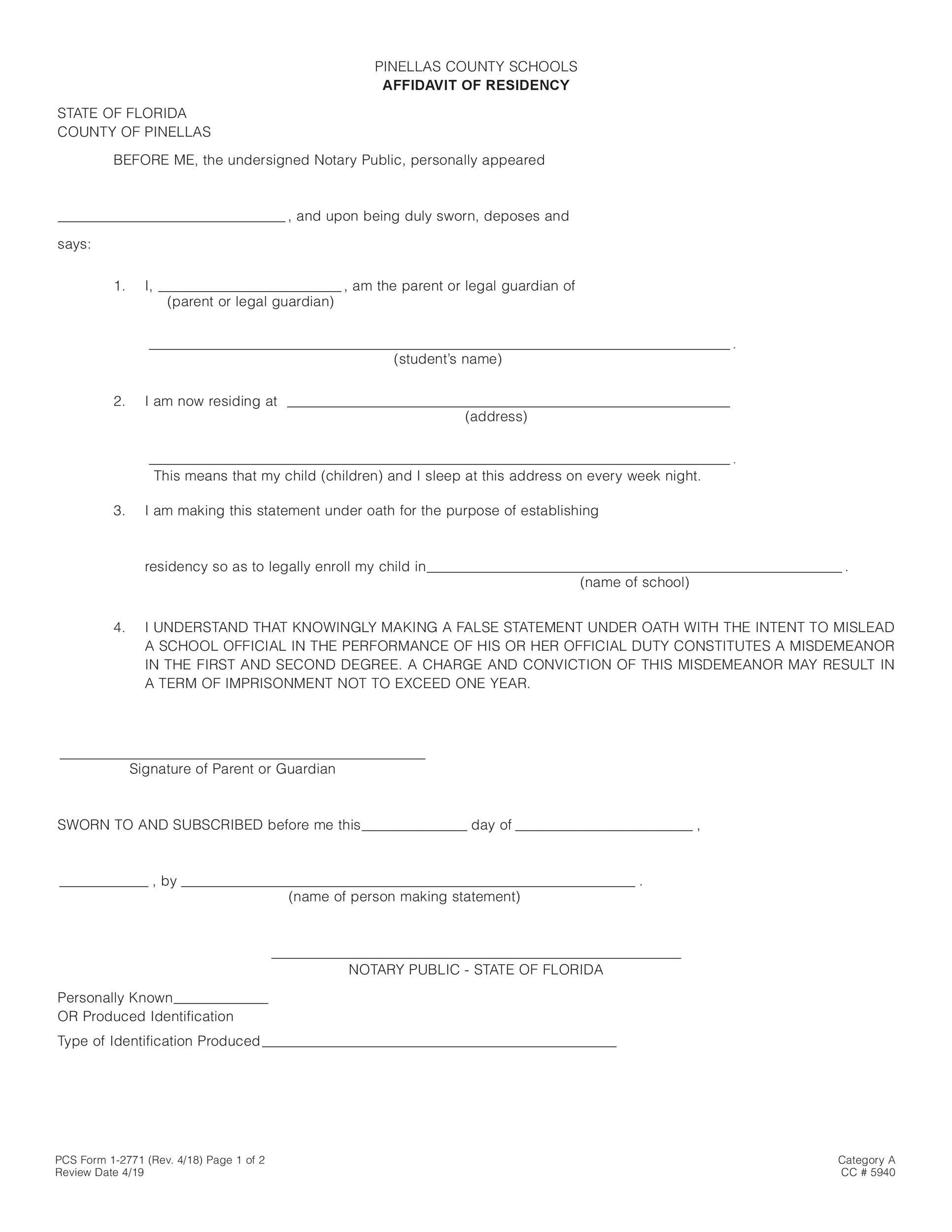

Proof of Residency and Address Requirements

When applying for housing online, demonstrating your current residency is a crucial step in the process. Various documents can serve this purpose, and landlords often specify their preferences. Commonly accepted forms of proof may include:

- Utility Bills: Recent gas, water, or electricity bills that display your name and address.

- Lease Agreements: A signed rental agreement showing your occupancy.

- Bank Statements: Monthly statements featuring your name and address.

- Government Correspondence: Letters or notices from governmental bodies addressed to you.

It’s essential to ensure the documents you provide are recent—most landlords require proof dated within the last 30 to 90 days. If you’re uncertain about which type of documentation will meet their requirements, consider contacting the property management office ahead of time for clarification. Below is a simple reference checklist:

| document Type | Criteria |

|---|---|

| Utility Bill | Must show your name and address, dated within the last 3 months |

| Lease Agreement | Current and signed with your name on it |

| Bank Statement | Must show your name and address, dated within the last 3 months |

| Government Letter | addressed to you with a date |

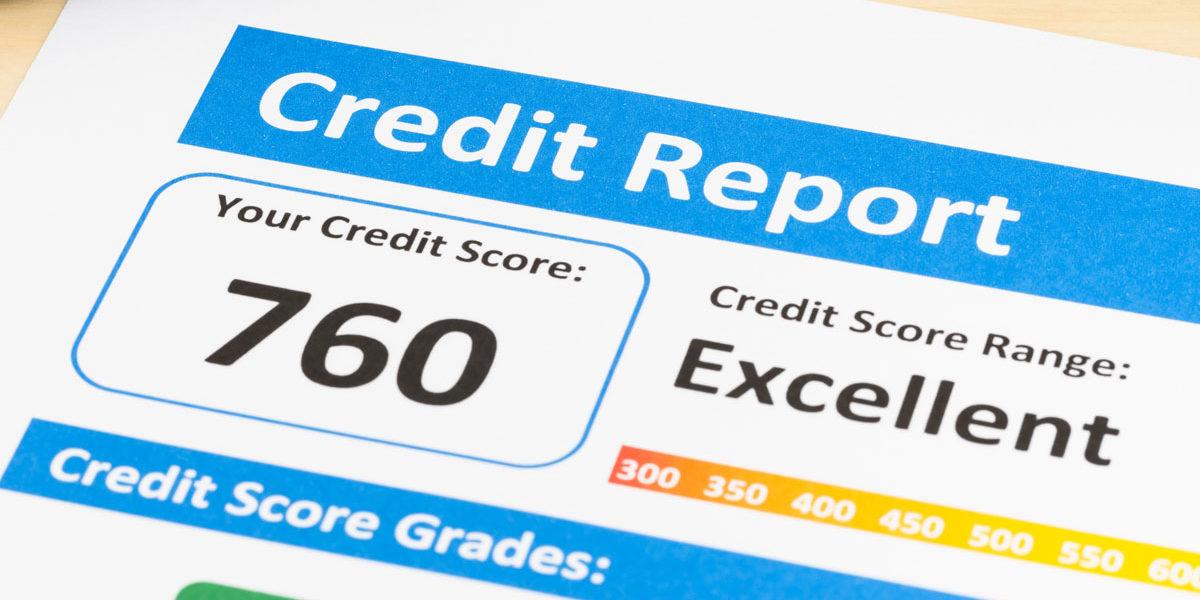

Understanding Credit reports and Their Role in Housing Applications

Before you dive into the housing application process,it’s crucial to understand the importance of your credit report,as it acts like a financial report card. Lenders and landlords often rely heavily on this document to assess your creditworthiness. Factors such as your payment history, outstanding debts, and length of credit history are scrutinized to determine whether you qualify for a lease or mortgage. A high credit score can lead to more favorable terms, such as lower interest rates or reduced deposits, while a poor score may limit your options or even disqualify you altogether. Thus, it’s wise to review your credit report regularly and take action to rectify any errors or improve your score before applying.

When preparing your housing application, be aware of the key elements included in your credit report that landlords typically evaluate.These can include:

- Payment History: Past on-time payments vs. missed payments

- Credit Utilization: Amount of available credit being used

- Length of Credit History: Age of your oldest account

- Types of Credit Accounts: Mix of credit cards, mortgages, and other loans

Understanding these components is essential because they not only impact your immediate housing application but also your overall financial future. By staying informed and proactive about your credit status, you can effectively navigate the application process, making it easier to secure a place you can call home.

Navigating Additional Documentation for Specific Housing Types

When applying for different types of housing, understanding the specific documentation required can save you time and reduce stress.For single-family homes, you may typically need to provide a combination of personal identification, proof of income, and sometimes even testimonials from previous landlords. Essential documents might include:

- Government-issued ID: A valid driver’s license or passport.

- Pay stubs or tax returns: To confirm your income level.

- Credit report: Lenders often require this to evaluate your financial health.

For condominiums or co-ops, the process may vary slightly due to the governing boards’ specific requirements.In addition to personal identification and income verification,you will frequently enough need to furnish additional documents such as:

- Homeowner Association (HOA) agreements: Acknowledging the rules and regulations of the community.

- Application forms: Specific to the building or complex.

- Board approval: for co-op applications, be prepared to submit to an interview process.

in certain cases where documentation can become extensive,a simple table can definitely help you visualize what each type of housing requires:

| Housing Type | Common Documents Needed |

|---|---|

| Single-Family Home | ID,Income Proof,Credit Report |

| Condominium | ID,HOA Agreements,Application Forms |

| Co-Op | ID,Board approval,Interview |

Q&A

Q&A: What Documents Do You Need to Apply for Housing Online?

Q: What is the first document I need to gather for an online housing application?

A: The very first document to secure is your identification. Typically, a valid government-issued ID such as a driver’s license or passport will suffice. This helps landlords verify your identity and ensures a smooth application process.

Q: Do I need to show proof of income?

A: Yes, proof of income is crucial. Landlords want to ensure that you can afford rent without stretching your budget too thin. common documents include recent pay stubs, tax returns, or bank statements demonstrating consistent income, especially if you’re self-employed.

Q: are there any financial documents required?

A: Absolutely! Besides proof of income,you might need a credit report or score. Some landlords conduct their own credit checks,but providing your report can expedite the process and show openness. Be prepared to present information regarding any outstanding debts as well.

Q: What about rental history?

A: Rental history is important! Landlords often want to know where you’ve lived before and how reliable you were as a tenant. A list of previous addresses, contact information for previous landlords, and perhaps even letters of proposal can bolster your application.

Q: Do I need personal references?

A: Most likely! Personal references can add credibility to your application. These could be friends, family, or colleagues who can vouch for your character and reliability. It’s wise to ask them beforehand so they’re prepared to provide a glowing recommendation.

Q: Is there any specific format or style I should follow for these documents?

A: While each housing platform may have its preferences, clarity and organization are key! Ensure that all documents are legible, well-organized, and preferably in PDF format to maintain integrity. Also, check the application guidelines for any additional requirements like file sizes or specific formats.

Q: How about application fees? Are they considered a document?

A: While not a document in the traditional sense, be prepared to pay an application fee—this may be required to process your application or run background checks. Documentation related to your fee payment, such as receipts or confirmations, should be saved for your records.

Q: Lastly, is there anything else I should consider?

A: Yes, keep yourself organized! Maintain an electronic folder for digital copies of all your documents, and consider creating a checklist to ensure you have everything you need before submitting your application.Being thorough can set you apart in a competitive housing market!

By prepping these essential documents,your online housing application will be swift and seamless,boosting your chances of landing that perfect place to call home!

Key Takeaways

navigating the world of online housing applications can be a daunting task,but being prepared with the right documents can simplify the process significantly. By gathering essential paperwork such as identification, proof of income, references, and credit history, you can bolster your application and improve your chances of securing your desired home. Remember, each housing provider may have specific requirements, so it’s always a good idea to check their guidelines in advance. With a well-organized approach and the right documentation at your fingertips, you’ll be well on your way to making your online housing journey a prosperous one. Happy house hunting!