Choosing the right payroll provider for your small business can be overwhelming. With so many options available, it’s essential to find a service that meets your business’s unique needs. Payroll providers offer more than just paycheck processing; they ensure compliance with tax laws, integrate with HR systems, and provide automation to make your payroll operations seamless. Let’s explore what to consider when selecting the best payroll provider for your business.

Why Choosing the Right Payroll Provider Matters

Payroll is a critical function of any business. Mistakes in payroll processing can lead to penalties, employee dissatisfaction, and compliance issues. That’s why selecting a reliable payroll provider is crucial to running a smooth and efficient business.

Key Factors to Consider When Choosing a Payroll Provider

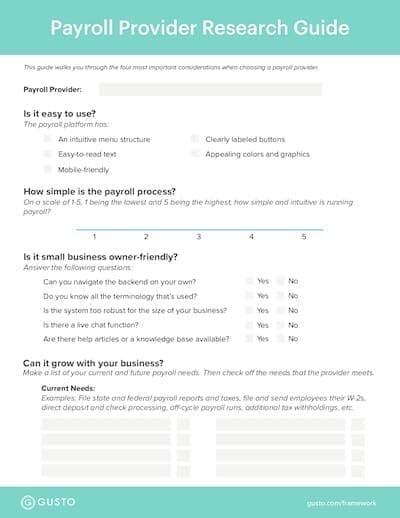

1. Ease of Use

A payroll system should be simple and intuitive. If the software is difficult to navigate, it can lead to frustration and errors. Look for a payroll provider that offers:

- A user-friendly interface

- Easy navigation with clear menu structures

- A mobile-friendly experience for on-the-go payroll processing

- A simple and efficient payroll process that saves time

A good payroll system should allow you to run payroll in just a few clicks without confusion or complications.

2. Designed for Small Business Owners

Not all payroll providers cater to small businesses. Some are designed for accountants and large enterprises, making them complex and challenging to use. Small business owners should look for payroll services that offer:

- Simple and easy-to-understand terminology

- Customer support that understands small business needs

- Features tailored to small businesses, such as automated tax filings and employee self-service options

Additionally, common payroll mistakes such as misclassifying employees, incorrect tax filings, and payroll schedule errors can be avoided with a payroll provider that prioritizes small business needs.

3. Scalability and Growth Support

Your business will grow, and your payroll provider should grow with you. Choose a provider that offers flexibility and add-on features as your business expands. Consider:

- The ability to handle an increasing number of employees

- Additional services such as health benefits, retirement plans, and PTO tracking

- Integration with HR tools for seamless workforce management

A payroll provider that can scale with your business ensures you won’t need to switch providers frequently, saving time and effort in the long run.

4. Compliance and Tax Support

One of the biggest challenges of payroll management is staying compliant with tax laws. A good payroll provider should offer:

- Automatic tax calculations and filings

- W-2 and 1099 form processing

- State and federal tax compliance support

- Alerts and reminders for tax deadlines

By choosing a provider with strong compliance support, you can avoid costly tax penalties and ensure accuracy in your payroll processing.

5. Cost Considerations

While cost is an important factor, it should not be the only deciding factor. Instead of choosing the cheapest option, consider the overall value a payroll provider offers. Look at:

- Base fees and pricing structure (monthly or per payroll run)

- Cost per employee or contractor

- Any additional service fees for tax filings, direct deposit, or benefits management

- Setup fees and contract terms

A payroll provider that fits your budget while offering essential features and excellent support will provide the best return on investment.

Switching to a New Payroll Provider

If you’re unhappy with your current payroll service, switching providers may be the right decision. Before making the switch, consider the following steps:

- Identify Pain Points with Your Current Provider

- Are there hidden fees?

- Is customer support unresponsive?

- Is the system difficult to use?

- Research and Compare Providers

- Request demos and trials

- Compare features and pricing

- Read customer reviews and testimonials

- Plan the Transition

- Ensure your new provider handles tax filings and compliance

- Transfer payroll data securely

- Inform employees about the switch

- Run a Test Payroll

- Process a sample payroll to check for errors

- Verify employee details and tax deductions

Switching providers can seem daunting, but with proper planning, the process can be smooth and beneficial for your business.

Final Thoughts

Selecting the right payroll provider is an important decision that affects your business’s efficiency and compliance. By focusing on ease of use, small business compatibility, scalability, compliance support, and cost, you can choose a payroll provider that fits your needs. Take the time to research and compare options, request demos, and ensure the provider aligns with your long-term business goals. With the right payroll service, you can focus on growing your business while payroll runs seamlessly in the background.