In 2024, 6.1 million American homeowners chose not to have home insurance, according to the Consumer Federation of America. Without coverage, they risk paying significant amounts of money out of pocket for repairs, replacements, or liability claims when accidents or disasters strike. Having the right insurance is crucial for protecting yourself from unexpected financial burdens.

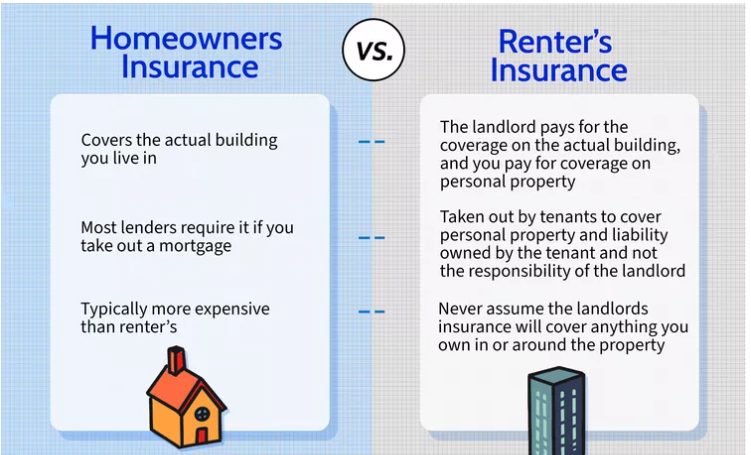

So, do you need renters insurance or homeowners insurance? The answer depends on whether you rent or own your home. While both types of insurance protect your belongings, they offer different coverage depending on your living situation.

Renters Insurance: What It Covers

The primary difference between renters and homeowners insurance is that renters don’t need to pay for dwelling coverage, which helps rebuild a home if it’s damaged. Renters insurance is usually more affordable because it only covers personal property, not the structure of the building.

Renters insurance typically includes:

- Personal Property Coverage: This protects your belongings, such as furniture, electronics, and clothes, from damage or theft due to events like fire or break-ins.

- Liability Coverage: This helps protect you if someone is injured while in your rental home and decides to sue.

- Loss of Use Coverage: If your rental becomes uninhabitable due to damage, this coverage helps pay for temporary housing and other living expenses like food and storage.

- Medical Payments Coverage: If a guest is injured in your home, this coverage pays for their medical expenses, regardless of fault.

Many people mistakenly think their landlord’s insurance will cover their personal property. However, most landlords’ policies only cover the building and issues like negligence. They won’t help if your personal items are damaged or stolen.

Homeowners Insurance: What It Covers

Homeowners insurance offers similar protection to renters insurance, but it also includes two important coverage options:

- Dwelling Coverage: This protects the structure of your home in case of damage from covered events like fire or storms, paying for repairs or rebuilding.

- Other Structures Coverage: This covers detached structures on your property, such as garages, sheds, or fences, if they are damaged.

A standard homeowners policy also includes personal property coverage, liability protection, and loss of use coverage, just like renters insurance. Ensuring your dwelling, personal property, and liability coverage are adequate is crucial so you aren’t left financially vulnerable if disaster strikes.

Gaps in Coverage

Both renters and homeowners insurance policies have some important exclusions:

- Flood Damage: If you live in an area prone to flooding, you’ll need additional flood insurance since most standard policies don’t cover this.

- Earthquake Damage: Earthquake coverage is also separate and needs to be added if you live in an earthquake-prone area.

- Normal Wear and Tear: Regular maintenance issues and aging of the property are not covered by insurance.

- High-Value Items: Expensive items like jewelry, fine art, or collectibles may need additional coverage.

- Business Equipment: If you use equipment for business purposes, it may require separate insurance depending on its value.

It’s essential to carefully review your policy and understand what is and isn’t covered. Additional coverage might be needed based on your location or valuable possessions.

Factors That Affect Insurance Rates

Several factors impact the cost of your insurance, whether you have renters or homeowners insurance:

- Location and Natural Disaster Risk: The state you live in can significantly influence your premiums. States that experience frequent natural disasters like floods, wildfires, or hurricanes tend to have higher insurance rates. Additionally, your proximity to emergency services, such as fire stations and hydrants, can affect rates. Homes near these services often receive lower rates.

- Personal Factors and Policy Choices: Your personal profile also plays a role. Insurers often look at your credit score and past claims history when determining rates. For both renters and homeowners insurance, a higher credit score may result in lower premiums.

- Deductible: The amount you choose for your deductible will also impact your monthly premium. A higher deductible usually lowers your monthly premiums, but it means you’ll pay more out of pocket when you make a claim.

The Bottom Line

While renters and homeowners insurance aren’t legally required, it’s important not to skimp on coverage. Rebuilding your life after a disaster is tough enough, and having to pay out of pocket for damages makes it even harder. To ensure you’re adequately covered, consider bundling your insurance policies, such as combining your renters or homeowners insurance with auto insurance to save money.

Rates and coverage options can vary, so be sure to compare quotes from different insurers to find the best deal for you. Working with a licensed insurance agent will help you find a policy that fits your needs and budget, whether you’re renting or owning.